In the dynamic terrain of modern business, the symbiosis of venture capital (VC) and innovation forms the bedrock of technological progress and entrepreneurial success. Venture capital is not merely a source of funding; it is a powerhouse that fuels the fires of innovation, turning nascent ideas into groundbreaking realities. This potent relationship is at the heart of the startup ecosystem, propelling forward a myriad of transformative technologies and disruptive business models. As we delve into the role of VC, we uncover how it acts not just as financial backing but as a catalyst for change, challenging the status quo and ushering in a new era of technological evolution and market transformation.

The Driving Force of Venture Capital in Innovation

Venture capital stands as a cornerstone in the world of innovation. Beyond the infusion of capital, it endows startups with a wealth of resources – from strategic expertise and industry insights to mentorship and access to expansive networks. This multifaceted support system is vital in nurturing nascent companies through their formative stages, guiding them through complex market landscapes and operational challenges.

Transforming Ideas into Industry Milestones

The history of technological advancement is dotted with examples where venture capital has played a pivotal role. From the early bets on companies like Apple and Google to the more recent investments in the likes of Uber and Airbnb, VC has been instrumental in bringing revolutionary ideas to life. These companies, once mere concepts, have reshaped entire industries, showcasing how venture capital is crucial in translating innovative visions into tangible, world-altering services and products.

Attracting Venture Capital for Your Innovative Idea

For entrepreneurs aiming to transform their innovative ideas into successful ventures, attracting the right venture capital is a critical step. The journey to securing VC investment involves a blend of preparation, strategy, and communication.

Crafting the Blueprint of Success

Developing a robust business plan is the first step. This plan should clearly articulate your vision, market opportunity, value proposition, and financial projections. It’s not just about the idea itself but how it will materialize into a viable, profitable business.

Building Your A-Team

Assemble a team that reflects not only the skills necessary to build your product or service but also the drive and passion to see it through. Venture capitalists invest in people as much as they do in ideas. A strong, committed team is often the linchpin in securing VC funding.

Demonstrating Market Potential

Show potential investors that there is a market for your innovation. This involves thorough market research, understanding your target audience, and demonstrating a clear path to capturing and growing your market share.

Mastering the Art of Networking and Pitching

Building relationships is key in the venture capital world. Networking, attending startup events, and engaging with the VC community can open doors to investment opportunities. Coupled with this is the ability to create compelling pitches – narratives that not only highlight the potential of your idea but also resonate with the investor’s interests and goals.

In attracting venture capital, the amalgamation of a well-crafted business plan, a passionate team, market insight, and effective networking skills can set the stage for a successful investment journey. This process is not just about securing capital; it’s about forging partnerships that can drive your innovative idea to new heights.

5 Ways Venture Capital Spurs Technological Innovation

Venture capital is not just a funding mechanism; it’s a dynamic force that propels technological innovation forward in numerous ways. Here are five key avenues through which venture capital nurtures and accelerates tech advancements:

1. Funding High-Risk, High-Reward Projects: Venture capitalists are known for their willingness to back ambitious, high-risk projects. This risk appetite allows them to fund groundbreaking technologies that might otherwise struggle to secure traditional financing, paving the way for potentially disruptive innovations.

2. Bridging the Gap Between Research and Market: Many technological breakthroughs begin in research labs but need financial and strategic support to reach the market. Venture capitalists provide this bridge, transforming theoretical research into viable, marketable products.

3. Providing Expertise and Mentorship to Startups: Beyond capital, VC firms bring a wealth of knowledge and experience. They mentor entrepreneurs, offering insights on everything from product development to market strategies, significantly increasing the likelihood of a startup’s success.

4. Encouraging Collaboration and Cross-Industry Innovation: Venture capitalists often foster environments where startups can collaborate and share ideas. This cross-pollination of knowledge encourages innovative solutions that may not have been possible in siloed settings.

5. Driving Competition and Accelerating Market Entry: By funding multiple companies within the same sector, VCs create a competitive landscape, spurring faster innovation and quicker market entry. This competition drives startups to refine their offerings, benefiting consumers and the industry as a whole.

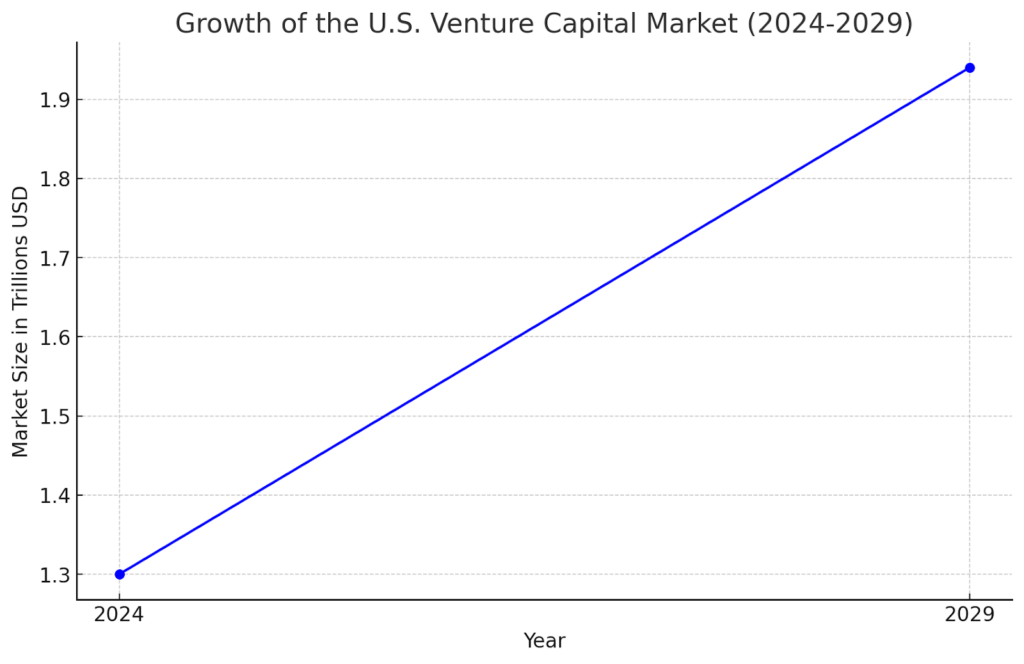

U.S. Venture Capital Market Growth (2024-2029)

The projected growth of the U.S. Venture Capital market is captured in a revealing graph, illustrating a significant upward trend from 2024 to 2029. The market size is expected to expand from USD 1.30 trillion in 2024 to USD 1.94 trillion by 2029, registering a compound annual growth rate (CAGR) of 8.25%. This growth trajectory signifies the escalating role of venture capital in driving innovation and entrepreneurship in the United States. The increasing market size reflects the growing confidence of investors in the venture capital sector and its potential to generate substantial economic returns while fostering technological advancements and new business models.

The Future Landscape of Venture Capital and Innovation

As we look towards the future, the role of venture capital in driving innovation is poised to evolve in response to global economic and technological changes. Industry leaders offer valuable insights into this evolution.

Emerging Trends in VC and Impact on Innovation

Leaders in the venture capital space are noticing shifts towards more diverse and inclusive investment practices, with a growing emphasis on sustainable and socially responsible ventures. There is an increasing interest in sectors like green technology, AI, and biotech, driven by global challenges and technological advancements.

Supporting New Sectors and Technologies

Venture capital is expanding its horizons, increasingly supporting sectors that promise to shape our future. Green technology, AI, and biotech are at the forefront of this shift. These sectors offer solutions to some of the world’s most pressing problems, from climate change to healthcare challenges, and VCs are key in bringing these solutions to life.

Adaptation to a Changing World

The venture capital industry is expected to adapt its strategies to align with changing global economic and technological landscapes. This includes a more global approach to investment, leveraging technology for better decision-making, and adapting to the evolving needs of startups in these new, dynamic sectors.

The future of venture capital is intrinsically linked to its ability to adapt and respond to emerging trends and global challenges. As it continues to evolve, its role in fueling innovation will expand, ushering in new eras of technological advancement and transformative solutions.

FAQs: Venture Capital and the Innovation Ecosystem

How Do Venture Capitalists Decide Which Startups to Invest In?

Venture capitalists typically look for startups with a unique value proposition, a scalable business model, and a strong team. They assess market potential, the product or service’s ability to address a significant problem, and the company’s overall growth potential. Additionally, they consider the entrepreneur’s passion, commitment, and ability to execute their vision.

What Role Do Venture Capitalists Play in Shaping a Startup’s Direction?

Venture capitalists often play a crucial role in shaping the strategic direction of a startup. Beyond funding, they provide mentorship, industry connections, and operational guidance. They can help in refining business models, setting long-term goals, and often have a say in major business decisions.

Can a Startup Succeed Without Venture Capital?

Yes, a startup can succeed without venture capital. Many businesses grow through bootstrapping, grants, crowdfunding, or angel investors. However, venture capital can accelerate growth, provide valuable resources, and open doors that might otherwise be difficult to access.

How Has the Role of Venture Capital in Promoting Innovation Changed Over the Years?

Over the years, venture capital has increasingly focused on not just financial returns but also on driving societal and technological change. There has been a shift towards investing in startups that address global challenges like climate change, healthcare, and sustainability. The rise of digital technologies has also expanded the scope of VC investments into diverse sectors like AI, fintech, and biotech.

In conclusion

Venture capital remains a cornerstone in the innovation ecosystem, continually proving its indispensable role in fueling groundbreaking ideas and shaping the industries of tomorrow. It transcends the boundaries of mere financial investment by embedding itself in the very fabric of business growth and technological advancement. This dynamic and ever-evolving field calls for a harmonious collaboration between visionary entrepreneurs and insightful investors, united in their pursuit of innovation, progress, and enduring impact. As we move forward, it is this spirit of continuous engagement and collaboration that will drive sustained innovation and foster robust growth in the entrepreneurial landscape.