Venture capital stands as a pivotal funding mechanism for startups and innovative projects, wielding the power to propel technological advancements and foster economic growth. This form of investment is tailor-made for new ventures with high growth potential but also high risk, offering them the crucial financial backing needed to scale operations, develop new products, and enter markets. The venture capital industry is characterized by its dynamic nature, with shifts in technology, the economy, and societal preferences significantly influencing investment strategies. As such, venture capitalists continually adapt their approaches to navigate the ever-changing landscape of opportunities and challenges.

The essence of venture capital is not just in providing financial resources but also in offering strategic guidance, operational expertise, and access to a broad network of industry contacts. This unique combination of capital and support enables startups to achieve milestones that would otherwise be unattainable, driving innovation and economic development.

The objective of this article is to delve into the emerging trends in venture capital investing, providing a comprehensive analysis of how these trends are reshaping the landscape of startup financing and the broader economic context. By identifying and examining these trends, we aim to offer valuable insights to entrepreneurs seeking venture capital and to investors looking to adapt to the evolving market.

Understanding Venture Capital Investing

The Basics of Venture Capital

Venture capital is a form of private equity and a type of financing that investors provide to startups and small businesses that are believed to have long-term growth potential. Unlike traditional financing methods, venture capital typically comes from well-off investors, investment banks, and any other financial institutions. However, it does not always take a monetary form; it can also be provided in the form of technical or managerial expertise. Venture capital is crucial in the startup ecosystem because it focuses on companies that are too risky for standard bank loans or equity markets. This type of investment is unique because it focuses not only on providing financial support but also on adding value through strategic partnerships, mentoring, and leveraging the investor’s network.

Venture capital differs from other forms of investment in its high-risk, high-reward nature, its focus on innovative companies with the potential for exponential growth, and its involvement in the operations of the investee company to secure its success. These characteristics make venture capital a vital driver of innovation and a significant contributor to economic development, particularly in sectors like technology, healthcare, and renewable energy, where upfront investment costs can be substantial.

The Venture Capital Process

The venture capital process is a structured journey from deal sourcing to exit strategies, involving several key stages. Initially, venture capitalists source deals through their networks, events, and direct submissions from startups. Once a potential investment is identified, the venture capital firm conducts extensive due diligence to assess the viability, market potential, and team capability of the startup. This evaluation includes analyzing the business model, financial performance, competitive landscape, and legal considerations.

After due diligence, if the venture capital firm decides to proceed, it negotiates the terms of the investment with the startup, leading to the drafting of term sheets and, eventually, legal investment documents. The investment is then made, typically in exchange for equity in the company, and the venture capitalist often secures a seat on the board of directors.

The post-investment phase involves active engagement with the startup, providing strategic guidance, operational advice, and access to networks to fuel growth and increase the company’s value. The ultimate goal of venture capital investing is to achieve a successful exit, typically through an initial public offering (IPO) or a sale of the company (acquisition), allowing the venture capitalist to realize a return on investment. This exit strategy is crucial as it not only provides financial returns but also enables the venture capital firm to reinvest capital into new innovative ventures, perpetuating the cycle of innovation and growth.

The venture capital process is intricate, requiring a delicate balance between risk management and the pursuit of high-growth opportunities. It underscores the venture capital industry’s pivotal role in supporting startups that are at the forefront of innovation and economic expansion.

Navigating the Current Venture Capital Landscape

Identifying Promising Startups

Venture capitalists (VCs) employ a meticulous approach to identify startups with the potential for high growth. This process is grounded in a set of criteria that often includes the uniqueness of the business idea, the scalability of the business model, the strength and diversity of the founding team, and the startup’s market potential. VCs look for innovative solutions that address significant pain points or create new markets. They also value startups that can scale rapidly with a clear path to profitability. The founding team’s expertise, track record, and ability to adapt to changes are critical factors, as these qualities often determine a startup’s resilience and capability to overcome challenges. Strategies to identify these startups include leveraging industry networks, attending pitch events, and utilizing proprietary technology to scout and analyze potential investments systematically.

Due Diligence and Investment Decision Making

The due diligence process is a comprehensive evaluation that venture capitalists undertake before making an investment decision. This process encompasses financial, legal, and operational assessments to ensure the startup’s business model is viable and the investment is sound. Financial due diligence involves examining the startup’s revenue model, profit margins, cash flow, and growth projections. Legal due diligence ensures that the startup has all necessary licenses, complies with regulations, and has clear ownership of its intellectual property. Operational due diligence assesses the startup’s internal processes, technology infrastructure, and market positioning. This thorough evaluation helps VCs mitigate risks and make informed decisions about proceeding with the investment.

Building a Diverse Investment Portfolio

Diversification is a cornerstone of risk management in venture capital investing. By building a diverse investment portfolio, VCs can spread risk across various industries, stages of company growth, and geographical regions. This strategy helps mitigate the impact of individual investment failures on the overall portfolio’s performance. Tips for achieving diversification include investing in startups operating in different sectors, varying investment sizes based on risk assessment, and exploring opportunities in emerging markets. This approach not only reduces risk but also maximizes the potential for high returns, as it allows VCs to capitalize on growth opportunities across a broader spectrum of the innovation ecosystem.

Charting the Course: The Evolution of Venture Capital Investment Trends

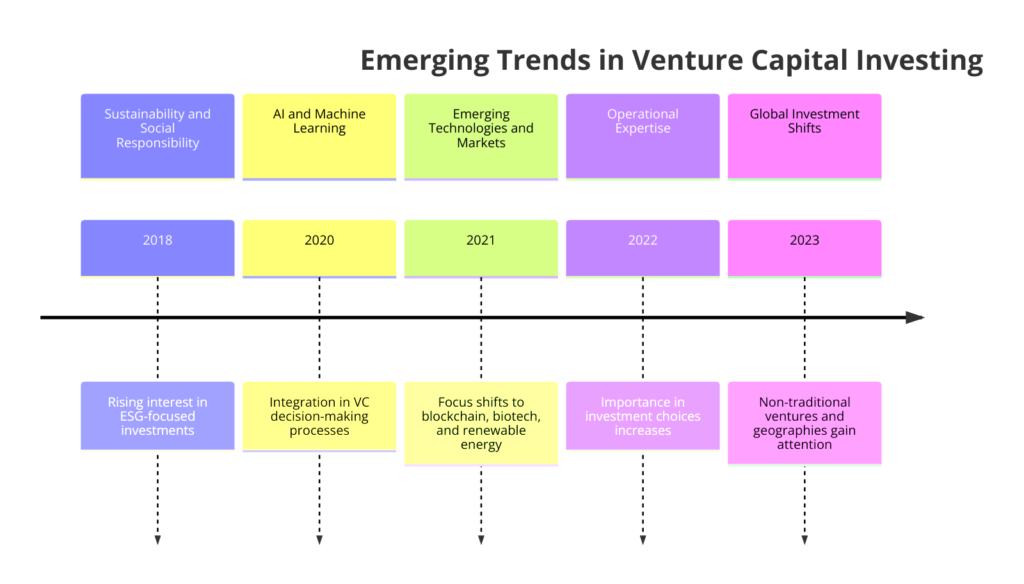

The venture capital (VC) industry has undergone significant transformation, characterized by an evolving investment landscape that mirrors the rapid pace of technological advancements and changing global economic dynamics. This evolution is not merely a reflection of the VC industry’s adaptability but also a testament to its role as a catalyst for innovation and economic growth. The timeline above encapsulates the pivotal trends shaping the future of venture capital investing.

Sustainable and Socially Responsible Investments

Beginning in 2018, there has been a discernible shift towards investments that prioritize environmental, social, and governance (ESG) criteria. This trend underscores a growing recognition of the long-term value and impact that sustainable and socially responsible startups can deliver. Venture capitalists are now more inclined to back companies that not only promise attractive financial returns but also contribute positively to societal and environmental outcomes.

The Integration of AI and Machine Learning

By 2020, artificial intelligence (AI) and machine learning (ML) began to revolutionize VC decision-making processes. These technologies have enabled investors to analyze vast amounts of data with unprecedented speed and accuracy, uncovering insights that drive smarter, more informed investment choices. This data-driven approach has enhanced the ability of VCs to identify promising startups early and optimize their investment strategies for maximum impact.

Focus on Emerging Technologies and Markets

The year 2021 marked a significant pivot towards startups operating in blockchain, biotechnology, renewable energy, and other emerging technologies. This trend reflects the VC industry’s appetite for innovation and its commitment to funding ventures that are poised to redefine industries. Moreover, there has been a growing interest in exploring opportunities beyond traditional tech hubs, signaling a move towards a more globally inclusive approach to venture capital investing.

The Growing Importance of Operational Expertise

In 2022, operational expertise emerged as a crucial factor in investment decisions. Venture capitalists began placing greater emphasis on the management teams of startups, recognizing that operational excellence is a key determinant of a company’s ability to scale and succeed. This shift highlights the role of VCs as active partners who contribute not just capital but also strategic guidance to help startups navigate the complexities of growth.

Global Investment Shifts

By 2023, the venture capital landscape had expanded to embrace non-traditional ventures and geographies, driven by the search for untapped markets and innovative business models. This trend towards diversification is indicative of the VC industry’s resilience and its relentless pursuit of opportunities that offer both financial returns and the potential to drive meaningful change.

As we look to the future, these trends signify a dynamic period of growth and transformation for the venture capital industry. The focus on sustainability, technological innovation, and global inclusivity will continue to influence how investments are made, shaping the trajectory of startups and the broader ecosystem of innovation and entrepreneurship.

Top 5 Emerging Trends in Venture Capital Investing

1. Increasing Focus on Sustainable and Socially Responsible Investments

Sustainability and social responsibility are becoming increasingly important in venture capital investing. Investors are showing a strong preference for startups that prioritize environmental, social, and governance (ESG) criteria, recognizing that these factors can drive long-term success and positive societal impact. This trend reflects a broader shift towards responsible investing, with VCs seeking to contribute to global challenges such as climate change and social inequality while achieving financial returns.

2. The Rise of AI and Machine Learning in VC Decision Making

Artificial intelligence (AI) and machine learning (ML) are transforming VC decision-making processes. VCs are leveraging these technologies to analyze vast amounts of data on potential investments, gaining insights into market trends, startup performance, and risk factors at unprecedented speeds and accuracy. This data-driven approach enables more informed investment decisions, optimizing portfolio performance and uncovering hidden opportunities in the startup ecosystem.

3. Growing Interest in Emerging Technologies and Markets

Venture capital is increasingly gravitating towards startups that innovate in emerging technologies and markets. Areas such as blockchain, biotechnology, and renewable energy are attracting significant investment, fueled by the potential for these technologies to disrupt traditional industries and create new economic opportunities. Similarly, VCs are expanding their geographical focus, investing in startups outside traditional tech hubs to tap into global innovation and emerging markets’ growth potential.

4. The Importance of Operational Expertise in Investment Choices

Operational expertise has become a critical factor in VC investment choices. VCs are not only providing capital but also actively participating in shaping the strategic direction and operational efficiency of their portfolio companies. Startups that demonstrate strong management teams with operational excellence are more likely to attract investment, as VCs look for teams that can execute their vision effectively and navigate the complexities of scaling a business.

5. Shift Towards Non-Traditional Ventures and Geographies

There is a noticeable shift towards non-traditional ventures and geographies in venture capital investing. VCs are exploring investments in niche markets and unconventional business models that promise high growth potential, such as space technology, alternative food sources, and digital health. Additionally, there is an increasing interest in startups based in emerging economies, driven by the desire to tap into new consumer markets and innovation hotspots outside of Silicon Valley and other established tech centers.

These emerging trends in venture capital investing highlight the industry’s evolving landscape, marked by a focus on sustainability, technological innovation, operational expertise, and the exploration of new markets and geographies. As these trends continue to develop, they will shape the future of venture capital, influencing how investments are made and the types of startups that will lead the next wave of economic growth and innovation.

The Future of Venture Capital

The venture capital landscape is undergoing transformative changes, driven by evolving market dynamics, technological advancements, and shifting investor priorities. This evolution presents a visionary outlook for the future of venture capital investing, characterized by increased emphasis on sustainability, technological innovation, and global inclusivity.

Visionary Outlook

Current trends in venture capital are setting the stage for a future where investment decisions are increasingly influenced by environmental, social, and governance (ESG) factors. The integration of artificial intelligence and machine learning in investment strategies is expected to become more sophisticated, enabling venture capitalists to make more informed and data-driven decisions. Moreover, the exploration of emerging technologies and markets, particularly in regions outside traditional tech hubs, is likely to broaden, diversifying the landscape of venture capital investment and opening up new avenues for growth and innovation.

Impact on Startups and Innovation

These trends have significant implications for startups and the broader innovation ecosystem. Startups that align their business models with sustainable practices and focus on solving global challenges are poised to attract more attention and funding from forward-thinking investors. The adoption of advanced technologies not only in product development but also in operational processes can enhance startups’ efficiency and scalability, making them more attractive to venture capitalists. Furthermore, the democratization of venture capital, facilitated by a shift towards non-traditional ventures and geographies, promises to spur innovation on a global scale, contributing to economic growth and societal progress worldwide.

Adapting to Change

To thrive in this evolving landscape, both investors and entrepreneurs must remain agile and adaptable. Venture capitalists should continue to expand their expertise in emerging technologies and sustainability to identify and capitalize on new investment opportunities. Embracing a global perspective and considering investments in diverse markets and sectors can also help VCs tap into untapped potential. For entrepreneurs, focusing on building resilient and adaptable business models, prioritizing innovation, and demonstrating a commitment to societal and environmental impact will be key to attracting venture capital in the future.

Some FAQs Answered on The Relevant Topic

What makes a startup attractive to venture capitalists?

A startup becomes attractive to venture capitalists when it demonstrates a unique and scalable business model, a strong and diverse team, a sizable market opportunity, and clear competitive advantages. The potential for high growth and a compelling value proposition are also critical factors.

How has the role of data analytics evolved in venture capital investing?

Data analytics has become central to venture capital investing, enabling VCs to perform deep market analysis, assess startup performance more accurately, and make data-driven investment decisions. The evolution of AI and machine learning technologies has further enhanced the capacity of VCs to analyze vast datasets, improving the efficiency and effectiveness of the investment process.

What are the biggest challenges facing venture capitalists today?

Venture capitalists today face challenges such as increased competition for high-quality deals, the need to adapt to rapidly changing technologies and markets, and the pressure to achieve sustainable and socially responsible investments. Navigating the regulatory landscape and managing the risks associated with early-stage investments also present significant challenges.

How can startups position themselves to be more appealing to venture capital firms?

Startups can become more appealing to venture capital firms by clearly articulating their value proposition, demonstrating market traction, showcasing a strong and committed team, and presenting a clear path to scalability and profitability. Aligning with current investment trends, such as sustainability and technological innovation, can also enhance their attractiveness.

In Conclusion

The emerging trends in venture capital investing, including the focus on sustainability, the rise of AI and machine learning, and the expansion into new technologies and markets, are reshaping the industry’s future. These trends not only highlight the evolving priorities of investors but also underscore the potential for venture capital to continue driving innovation and economic growth on a global scale. For both investors and entrepreneurs, staying informed and adaptable to these changes is paramount. As the venture capital landscape transforms, those who embrace the opportunities presented by these trends, with a commitment to sustainability and innovation, will be best positioned to succeed and make a lasting impact on the economy and society.