Venture Capital (VC) investments stand at the confluence of high risk and high reward, acting as a catalyst for innovation and growth in the bustling startup ecosystem. This realm of investment is not just about pumping money into promising startups; it’s about strategically nurturing these companies to foster groundbreaking innovations, drive growth, and, ultimately, reap significant returns. As we delve into the intricacies of building a successful VC portfolio, we’ll explore various strategies that savvy investors employ to strike a delicate balance between risk and reward. From decoding crucial financial metrics to fostering robust relationships with portfolio companies, this article aims to equip you with the insights needed to navigate the VC landscape effectively, ensuring long-term success and lucrative returns on your investments.

Foundations of VC Portfolio Management

Understanding Key Metrics

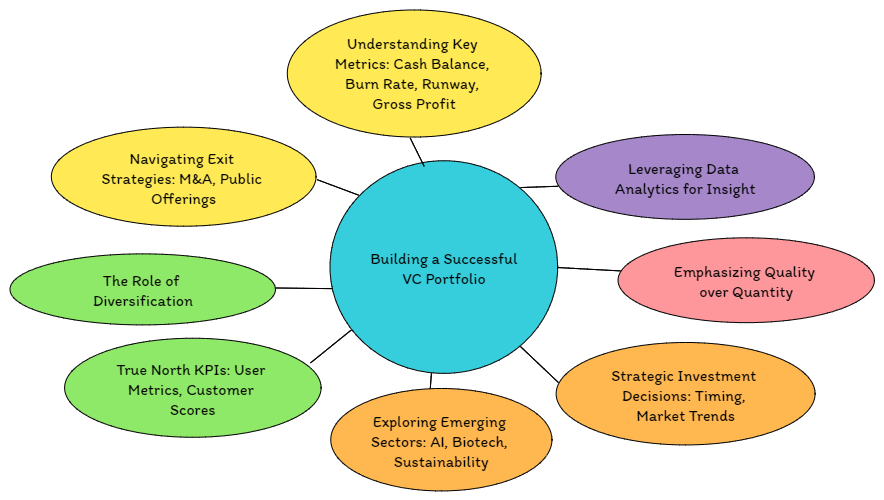

At the heart of VC investment strategies lies the critical analysis of key financial metrics. Metrics such as Cash Balance, Burn Rate, Runway, and Gross Profit offer a clear snapshot of a company’s financial health and sustainability. These indicators not only help VCs decide on follow-up investments but also shape potential exit strategies. By keeping a close eye on these metrics, VCs can make informed decisions, gauge the financial viability of their investments, and plan their investment moves strategically.

True North KPIs

Beyond financial metrics, ‘True North’ KPIs play a pivotal role in guiding VC investments. These Key Performance Indicators—ranging from active users and customer net promoter scores to active customers and average contract values—offer a nuanced understanding of a company’s operational performance. Aligning with these KPIs allows VCs to assess how well a company stacks up against sector benchmarks, informing investment decisions and setting the stage for targeted growth strategies.

Mastering VC Portfolio Construction

Venture Capital (VC) investment represents a dynamic intersection of risk and opportunity, aiming not just to fund startups but to sculpt the very future of innovation and market disruption. As we peel back the layers of crafting a successful VC portfolio, we reveal a strategic tapestry woven from meticulous analysis, timing, and a deep commitment to nurturing growth. This section delves into the core strategies that underpin the assembly of a venture capital portfolio designed to maximize returns while navigating the inherent uncertainties of the startup ecosystem.

Foundations of a Stellar VC Portfolio

At the heart of venture capital success lies the judicious selection and management of investments, guided by a blend of financial acumen and market intuition. Here are the pivotal strategies that form the bedrock of a prosperous VC portfolio:

Key Financial Metrics: Investors rely on critical financial indicators like Cash Balance, Burn Rate, Runway, and Gross Profit to gauge a startup’s fiscal health. These metrics serve not only as a guide for potential follow-on investments but also inform strategic exit planning.

True North KPIs: Beyond mere numbers, True North Key Performance Indicators provide a holistic view of a startup’s operational success, offering benchmarks that align with sector-wide standards and pave the way for targeted growth initiatives.

Strategic Investment Decisions: Successful venture capitalists understand that timing is everything. Leveraging market trends and being at the right place at the right time can exponentially increase investment returns.

Data-Driven Insights: In today’s era, data analytics stands as a powerful tool in the VC toolkit, turning vast amounts of portfolio data into actionable insights that drive strategic decision-making and unearth growth opportunities.

Quality Over Quantity: A focused approach, emphasizing startups with solid market potential and robust execution capabilities, often yields better outcomes than a diversified but unfocused investment strategy.

Navigating Exit Strategies: Crafting exit strategies with foresight, whether through mergers and acquisitions, public offerings, or strategic sales, is crucial for optimizing returns and mitigating risks.

The Role of Diversification: A balanced portfolio, spread across various sectors and stages of development, helps mitigate the impact of individual failures, leveraging the growth potential of early-stage startups alongside the stability of more mature companies.

Embracing Innovation: Venturing into emerging sectors such as AI, biotechnology, and sustainability positions venture capitalists at the forefront of industry transformation, promising not just financial returns but also societal impact.

By adhering to these strategic pillars, venture capitalists can navigate the complexities of the startup landscape, crafting portfolios that not only withstand the test of time but also drive forward the frontiers of innovation and progress.

This comprehensive approach to building a VC portfolio underscores the multifaceted nature of venture capital investment, blending rigorous financial analysis with a keen eye for market potential and innovation. It serves as a guide for investors looking to make their mark in the vibrant world of venture capital, ensuring their investments pave the way for groundbreaking advancements and substantial returns.

Strategic Investment Decisions

Timing and Market Trends

The timing of investments can profoundly influence the success of VC endeavors. Astute investors pay close attention to market trends, understanding that the right investment at the right time can lead to outsized returns. Whether it’s investing in emerging technologies or capitalizing on market downturns to secure deals at more favorable valuations, recognizing and acting on timing and trends is crucial for staying ahead in the competitive VC landscape.

Leveraging Data Analytics

In today’s data-driven world, leveraging analytics for portfolio management has become indispensable. Tools that centralize and organize portfolio data not only streamline decision-making but also transform complex datasets into actionable insights. By employing data analytics, VCs can enhance their strategic planning, optimizing investment decisions, and identifying opportunities for growth and intervention. This analytical approach enables a more dynamic and informed strategy for portfolio management, ensuring that investments are aligned with overarching goals and market opportunities.

Maximizing Portfolio Potential

Emphasizing Quality over Quantity

In the venture capital realm, the mantra “less is more” often holds true. A focused investment in startups with immense market potential and distinct competitive advantages is more likely to yield significant returns than a scattergun approach. It’s crucial to prioritize investments in teams and execution over the allure of innovative technology alone. As history shows, even the most groundbreaking technology can falter without the right people steering the ship. Superior execution by a dedicated and skilled team can pivot and navigate through market challenges, turning potential into success. This approach requires a keen eye for identifying not just promising technology but also strong leadership and operational excellence.

Navigating Exit Strategies

A well-considered exit strategy is crucial for optimizing returns and minimizing risks in venture capital investment. Whether it’s through mergers and acquisitions (M&A), public offerings, or strategic sales, understanding the various exit paths and preparing for them well in advance is essential. Strategic exits require foresight and planning, often from the early stages of investment. They play a pivotal role in portfolio management, ensuring that when the time comes, both the VC firm and its portfolio companies are positioned to maximize returns and achieve their desired outcomes.

Crafting a Winning VC Portfolio

A Step-by-Step Approach

Building a successful VC portfolio starts with identifying potential investment areas that align with emerging market trends and possess a high growth potential. The next step involves rigorous due diligence to assess the viability, market potential, and competitive advantage of startups. This phase is critical in weeding out high-risk investments and focusing on those with the best prospects for success. Once investments are made, post-investment management becomes key, involving close collaboration with portfolio companies to guide them towards their growth targets and prepare for eventual exit strategies. This structured approach, from initial selection through to exit, ensures a cohesive strategy that maximizes portfolio potential and returns.

Overcoming Challenges

Venture capital investing is fraught with challenges, including market volatility, regulatory changes, and the inherent risks of startup failures. To navigate these challenges successfully, VCs need resilience and adaptability. This means staying informed about market and regulatory shifts, being prepared to pivot investment strategies as necessary, and providing robust support to portfolio companies to help them navigate their own challenges. A proactive, informed approach to portfolio management can help VCs anticipate challenges and mitigate risks, ensuring long-term success and stability for their investments.

Innovation and Adaptation

Exploring Emerging Sectors

Venture Capitalists thrive on the edge of innovation, constantly scouting for the next breakthrough that could redefine industries. Emerging sectors like Artificial Intelligence (AI), biotechnology, and sustainability are ripe with opportunities for those willing to take the plunge. AI continues to transform every facet of our lives, from healthcare diagnostics to customer service enhancements, signaling a sector that’s not just booming but revolutionizing business models. Biotech, particularly in the wake of global health crises, has shown its critical importance and potential for rapid growth. Sustainability, driven by a global push towards greener solutions, opens doors to investments in renewable energy, eco-friendly manufacturing processes, and sustainable agriculture. These sectors not only promise lucrative returns but also the opportunity to contribute positively to societal advancement and environmental preservation.

The Role of Diversification

Diversification is the safeguard against the inherent risks of venture capital investment. By spreading investments across various sectors and stages of business development, VCs can mitigate the impact of individual failures. Early-stage investments offer high growth potential but come with higher risks, while later-stage or pre-IPO investments might offer more stability but lower growth rates. Striking the right balance allows venture capitalists to harness the explosive potential of early-stage startups while buffering the portfolio with the relative security of more established companies. This strategy not only enhances the potential for rewards but also ensures a more stable and resilient portfolio capable of weathering market volatility.

Lessons from the Field

Insights from Successful VCs

Success in venture capital requires more than just capital; it’s about strategy, insight, and the ability to see potential where others see risk. Learning from seasoned VCs can offer invaluable lessons. For instance, the importance of focusing on the team behind a startup often outweighs the product or technology itself. A great idea is only as good as the team executing it, emphasizing the need for investing in people with the vision and capability to navigate the startup’s growth successfully. Furthermore, successful VCs understand that while not every investment will be a home run, those that are can significantly outweigh the losses. The key is not to fear failure but to manage and learn from it, ensuring that the portfolio is primed for those game-changing successes. Finally, embracing change and staying adaptable allows VCs to pivot strategies in response to emerging trends and market shifts, ensuring that their investments remain relevant and poised for growth.

In the volatile world of startups, the lessons from those who have navigated these waters successfully are invaluable. They teach budding VCs the importance of adaptability, the power of a strong team, and the critical role of strategic diversification.

Future Outlook and Trends

Adapting to the Ecosystem Economy

The evolving venture capital landscape is increasingly defined by the ecosystem economy, where traditional industry boundaries are becoming ever more fluid. Companies, especially in technology, are no longer confined to one sector but span across multiple, creating new investment opportunities and competitive advantages. This shift necessitates that venture capitalists not only fund startups but also understand and leverage these cross-industry ecosystems. Investments in startups that serve as connectors or enablers within these ecosystems can unlock significant value, driving innovation and fostering synergies across different market segments.

FAQs: Navigating VC Investment Queries

How important is diversification in a VC portfolio?

Diversification is crucial for mitigating risks. By investing across different sectors, stages, and geographies, VCs can spread risk and increase the chances of landing significant returns from a few successful investments.

How do VCs assess the risk of a startup?

Risk assessment involves analyzing market potential, the strength of the founding team, product uniqueness, and the startup’s financial health. VCs also consider broader economic trends and sector-specific challenges.

What factors influence startup valuation?

Valuation is influenced by market trends, the startup’s growth potential, competitive landscape, and past achievements. Negotiations between the startup and investors also play a critical role.

How do global economic trends impact VC investments?

Global trends can affect consumer behavior, funding availability, and overall market stability. VCs need to stay informed about these trends to make strategic investment decisions and adapt their portfolio strategies accordingly.

Conclusion: Crafting a Future-Proof VC Portfolio

In the dynamic world of venture capital, success hinges on a deep understanding of the startup ecosystem, strategic agility, and an unwavering commitment to evolution and learning. The best VCs not only manage risk and seize market opportunities but also cultivate robust relationships with their portfolio companies. Looking ahead, the ability to adapt to the burgeoning ecosystem economy, leverage emerging technologies, and navigate the intricacies of global economic trends will distinguish the leading venture capitalists. Crafting a future-proof VC portfolio requires a balanced approach to risk, an eye for transformative trends, and the foresight to invest in startups that promise not just financial returns but also drive forward the frontiers of innovation and progress.