In the dynamic world of financial technology (Fintech), a revolutionary change is underway, driven by the integration of Artificial Intelligence (AI). This integration is not just an incremental upgrade; it’s a fundamental reshaping of the Fintech landscape. AI in Fintech is a game-changer, offering unprecedented opportunities for innovation, efficiency, and customer service. From algorithm-driven decision-making to personalized financial advice, AI is redefining what’s possible in the realm of financial services. This transformation is not a glimpse into a distant future; it’s the reality that’s unfolding before us right now.

The journey of Fintech has been nothing short of remarkable. From its inception, where it was seen as a mere facilitator of payments and transactions, Fintech has evolved into a complex, multifaceted industry that encompasses a wide range of financial activities. In this evolution, AI has emerged as a pivotal force. The rising importance of AI in this sector is underscored by its ability to analyze vast amounts of data, predict trends, and offer insights that were previously unattainable. The marriage of Fintech and AI is not just an enhancement of financial services but a complete reimagining of how these services are delivered and experienced by customers.

This article aims to delve deep into this transformative alliance between AI and Fintech. We will explore how AI is not just an add-on but a key driver in the Fintech revolution. Our journey will take us through the various facets of AI applications in Fintech, from the basics of how it’s transforming traditional practices to the more complex realms of predictive analytics and personalized financial solutions. The objective is to provide you, the reader, with a comprehensive understanding of AI’s role in Fintech, coupled with actionable insights, strategies, and practical advice to leverage this technology for success in the financial sector.

The AI Revolution in Fintech

Understanding AI’s Role in Fintech: Transforming Financial Services

Artificial Intelligence is not just an auxiliary tool in Fintech; it’s a transformative force reshaping the very fabric of financial services. Its role extends from enhancing customer experiences to redefining risk management and compliance. AI’s capability to process and analyze large datasets rapidly and accurately is revolutionizing customer service. AI-driven systems are providing personalized financial advice, automating routine inquiries, and offering quick, efficient customer support. Furthermore, in the realm of fraud detection and risk management, AI algorithms are able to identify patterns and anomalies that might go unnoticed by human analysts, thereby significantly reducing the risk of fraud and financial crimes.

Key Technologies and Innovations: The Pillars of AI in Fintech

At the heart of AI’s transformative impact in Fintech are key technologies and innovations that are pushing the boundaries of what’s possible. Machine learning, a subset of AI, is playing a critical role in understanding customer behavior, enabling predictive analytics, and facilitating decision-making processes that are more accurate and efficient. Predictive analytics in Fintech is revolutionizing how financial institutions assess creditworthiness, predict market trends, and make investment decisions. Chatbots and virtual assistants, powered by AI, are enhancing customer interactions, providing round-the-clock assistance, and improving customer satisfaction. Additionally, the integration of blockchain technology with AI is opening new avenues for secure, transparent, and efficient transactions.

Implementing AI in Your Fintech Operations

In the rapidly evolving landscape of financial technology, the integration of Artificial Intelligence (AI) into various operations has become more than a trend—it’s a necessity for staying competitive and relevant. Implementing AI in Fintech requires a careful, step-by-step approach, as well as an awareness of best practices and potential pitfalls.

The journey begins with a thorough assessment of your needs and clear definition of your objectives. Ask yourself, where can AI add the most value in your operations? Is it in enhancing customer experiences, optimizing risk management, or perhaps in automating mundane tasks? Once your goals are set, the next step is selecting the right AI technology. This could range from sophisticated machine learning algorithms for predictive analytics to intelligent chatbots for customer service.

Data is the lifeblood of AI. Collecting, processing, and analyzing relevant data is crucial. This data will be the foundation on which your AI models are built and trained. Whether you decide to develop AI solutions in-house or acquire them from external providers, the integration of these solutions into your existing systems is a critical phase. It requires meticulous planning and execution to ensure compatibility and functionality without major disruptions.

Testing and iteration are key components of successful AI implementation. Trial runs in controlled environments allow you to fine-tune your AI models, ensuring they deliver accurate and reliable results. Equally important is the training and support for your team. Employees need to understand and be comfortable with the new AI tools to utilize them effectively.

Once your AI systems are up and running, continuous monitoring and evaluation become essential. This ongoing process helps in fine-tuning the systems, ensuring they adapt to new data and changing conditions. Being open to scaling your AI operations as your business grows will also be vital for long-term success.

However, implementing AI is not without its challenges. Understanding and adhering to regulatory compliance is critical, especially considering the sensitivity of data in the financial sector. Prioritizing customer experience is essential; AI should simplify, not complicate, the user’s journey. Ensuring data privacy and security is another crucial aspect, given the nature of financial services. It’s also important to avoid overdependence on AI; a balance between automated solutions and human judgment is often necessary. Lastly, AI systems are not set-and-forget tools; they require regular updates and maintenance to stay effective and relevant.

Incorporating AI into Fintech operations is a transformative move. It’s about leveraging technology to enhance efficiency, improve customer experiences, and drive innovation. With the right approach and strategy, AI can be a powerful ally in the journey of Fintech evolution.

The Transformative Impact of AI in Fintech

AI’s Rising Stature in Financial Technology

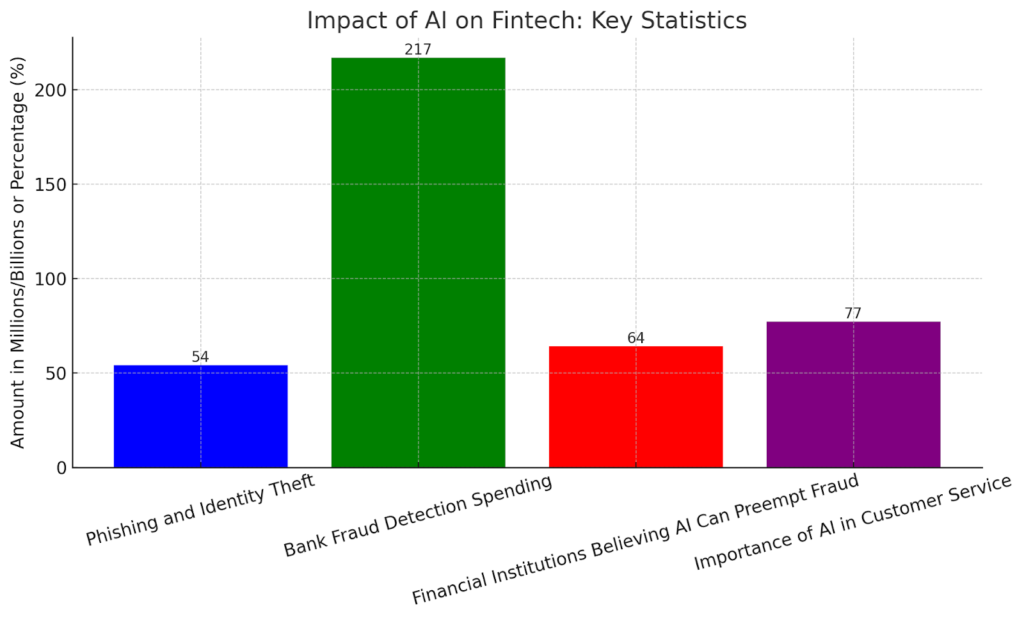

The integration of Artificial Intelligence (AI) into financial technology (Fintech) has initiated a paradigm shift in how financial services operate, evident from several key statistics. The bar graph illustrates the profound impact AI has had in areas like fraud detection, customer service, and financial security.

Phishing and Identity Theft: A Major Concern

AI’s role in combating phishing and identity theft is significant. In 2020, Americans lost over $54 million to phishing scams. The implementation of AI in detecting and preventing such fraudulent activities is crucial for the protection of both consumers and financial institutions.

Billion-Dollar Investment in Fraud Detection

AI’s potential in fraud detection is increasingly recognized by financial institutions, which spent over $217 billion on AI applications in 2021. This substantial investment underscores the confidence in AI’s capability to enhance fraud prevention mechanisms.

AI’s Proactive Role in Preempting Fraud

The belief in AI’s ability to proactively address fraud is high among financial institutions, with 64% asserting that AI can predict and prevent fraud before it occurs. This proactive approach is a testament to AI’s advanced analytical capabilities in identifying patterns and anomalies that might elude human detection.

AI in Customer Service: A Growing Imperative

Perhaps most notably, the significance of AI in customer service is evident, with 77% of financial service providers acknowledging its vital role. The use of AI-driven chatbots and machine learning algorithms in customer interactions not only improves efficiency but also enhances the overall customer experience.

These statistics collectively depict a landscape where AI is not just a technological add-on but a fundamental component of Fintech’s evolution. AI’s ability to analyze vast data sets, predict customer behavior, and offer real-time solutions is redefining the boundaries of financial services. As the sector continues to innovate, AI’s role in shaping the future of Fintech is undeniable, making it an indispensable tool for success in this ever-evolving industry.

Top AI Strategies for Fintech Success

- Personalized Financial Services: Utilize AI to offer personalized financial advice and product recommendations based on individual customer data.

- Advanced Fraud Detection: Implement AI algorithms that can detect fraudulent activities in real-time by analyzing transaction patterns and customer behavior.

- Automated Customer Service: Deploy AI-powered chatbots and virtual assistants to provide 24/7 customer service, reducing response times and improving customer satisfaction.

- Predictive Analytics for Risk Management: Use AI for predictive analytics to assess credit risk, market trends, and investment opportunities.

- Streamlining Operations: Apply AI to automate routine tasks, enhance operational efficiency, and reduce human error.

The Future of Fintech with AI

The financial technology sector is on the cusp of a transformative era, fueled by advancements in Artificial Intelligence (AI). Industry leaders and experts are increasingly recognizing the potential of AI to revolutionize every aspect of Fintech, from customer service and risk management to investment strategies and operational efficiency.

The future of Fintech with AI is poised to be marked by several emerging trends. One significant trend is the increasing personalization of financial services. AI’s ability to analyze vast amounts of data enables financial institutions to offer highly personalized products and services, tailored to the unique needs and preferences of each customer. Another trend is the automation of complex financial processes, which not only increases efficiency but also reduces human error, leading to more reliable and consistent outcomes.

The integration of AI in regulatory compliance and fraud detection is another area set to grow. Advanced AI algorithms are capable of monitoring transactions in real-time, detecting anomalies, and predicting potential risks, thus enhancing the security and integrity of financial operations.

The use of AI in predictive analytics will allow financial institutions to make more informed decisions by analyzing market trends, customer behavior, and economic indicators. This will lead to more strategic investment decisions and risk assessments, offering a significant competitive advantage in the rapidly evolving financial market.

Some FAQs Answered On The Relevant Topic

How is AI transforming customer service in Fintech?

AI is revolutionizing customer service in Fintech by providing personalized financial advice, automating routine inquiries, and offering 24/7 support through AI-powered chatbots and virtual assistants.

Can AI improve the accuracy of risk assessment in finance?

Yes, AI can significantly enhance risk assessment accuracy by analyzing large datasets to identify patterns and predict future trends, leading to more informed and strategic decision-making.

What role does AI play in fraud detection?

AI plays a crucial role in fraud detection by monitoring transaction patterns in real-time, identifying anomalies, and flagging potentially fraudulent activities, thereby reducing the risk of financial crimes.

How can AI help in personalizing financial products and services?

AI helps in personalizing financial products and services by analyzing customer data, understanding individual preferences, and tailoring offerings to meet specific customer needs.

Is AI in Fintech secure?

While AI brings numerous benefits, ensuring the security of AI systems in Fintech is crucial. This involves implementing robust data security measures, adhering to regulatory standards, and continuously monitoring AI systems for vulnerabilities.

In conclusion, the integration of AI in Fintech is not just a fleeting trend but a fundamental shift in the financial services landscape. This article has explored various strategies and insights into leveraging AI for success in Fintech. From implementing AI in operations to understanding its role in customer service, risk management, and regulatory compliance, we’ve delved into the transformative impact AI is having on the industry. As we look to the future, it’s clear that AI will continue to be a driving force in the evolution of Fintech. Staying ahead in this dynamic field will require embracing these technological advancements and continuously adapting to the ever-changing financial environment. For anyone involved in Fintech, the message is clear: the future is AI, and the time to adapt is now.