Venture capital (VC) serves as a vital catalyst for innovation and entrepreneurship, offering not just funding but also strategic guidance to early-stage startups with the potential to revolutionize industries and fuel economic expansion. This unique form of investment targets companies at the cusp of significant growth, providing them with the necessary capital to scale operations, refine products, and penetrate markets at an accelerated pace. The dynamic nature of the VC industry, characterized by its rapid adaptation to new technologies, economic fluctuations, and evolving societal demands, underscores its pivotal role in shaping the future of business and technology.

Over the past few decades, the venture capital landscape has undergone profound transformations, driven by the emergence of groundbreaking technologies, shifts in global economic power, and changing consumer behaviors. These factors, coupled with the increasing globalization of venture capital, have expanded the horizons of what is possible for startups and investors alike. The objective of this article is to delve into the predictions and possibilities that lie ahead for the venture capital industry, providing a comprehensive overview of the trends and strategies that are expected to influence investment decisions and the global startup ecosystem in the coming years.

The Current State of Venture Capital

Overview of the VC Landscape

The venture capital landscape today is a complex ecosystem comprised of a diverse array of players, including traditional VC firms, corporate venture arms, angel investors, and crowdfunding platforms. Dominant sectors that have traditionally attracted significant VC attention include technology, healthcare, and biotech, given their potential for disruptive innovation and high returns. However, recent years have seen a broadening of investment horizons to include emerging fields such as fintech, edtech, and cleantech, reflecting a growing recognition of the importance of sustainability and digital transformation across industries.

Geographically, while Silicon Valley remains a global powerhouse in venture capital, there has been a noticeable rise in activity in other regions around the world. Asia, led by China and India, has emerged as a significant player in the VC market, fueled by rapid economic growth, a burgeoning middle class, and a thriving tech startup scene. Europe, too, has seen its share of VC growth, with cities like London, Berlin, and Paris becoming hotspots for innovation and investment. This geographical diversification reflects the global nature of technological advancement and entrepreneurship, offering new opportunities and challenges for investors and startups alike.

Recent Trends and Developments

The venture capital industry is continually shaped by evolving trends and developments. One notable trend is the rise of corporate venture capital (CVC), with an increasing number of established companies launching their own VC arms to invest in startups that align with their strategic interests. This move not only provides corporations with a window into emerging technologies and business models but also offers startups valuable industry insights and networking opportunities.

The global economic conditions, characterized by periods of uncertainty and volatility, have also left their mark on the VC landscape. Economic downturns and market fluctuations can affect fundraising efforts, valuations, and exit strategies, prompting VCs to adopt more cautious investment approaches during such times. However, economic challenges can also lead to opportunities, as they may drive innovation and the creation of startups aimed at addressing new market needs.

Another significant development in the VC industry is the shift towards remote deal-making, accelerated by the COVID-19 pandemic. The necessity of social distancing and travel restrictions has led to an increased reliance on digital tools for sourcing deals, conducting due diligence, and managing investor-startup relationships. This digital transformation of the VC process has the potential to democratize access to venture capital, allowing startups from diverse geographical locations to attract investment more easily.

The current state of the venture capital industry, marked by its geographical expansion, sectoral diversification, and digital evolution, sets the stage for a future filled with both challenges and opportunities. As the industry continues to adapt to changing economic conditions, technological advancements, and societal needs, the predictions and possibilities for the future of venture capital become ever more intriguing and complex.

Preparing for the Future of VC

For Investors

As the venture capital landscape evolves, investors must adapt their strategies to stay ahead. Embracing technological tools is no longer optional; it’s imperative. Artificial Intelligence (AI) and big data analytics are revolutionizing how investments are sourced, evaluated, and managed. By leveraging these tools, VCs can gain deeper insights into market trends, startup performance, and risk factors, enabling more informed decision-making. Additionally, fostering diversity and inclusion within investment portfolios has become a crucial strategy. Investing in diverse founders and industries not only promotes social equity but also uncovers unique opportunities and perspectives that might otherwise be overlooked. Investors should actively seek out startups that challenge the status quo, offering innovative solutions to global challenges, thereby broadening their impact and potential for success.

For Entrepreneurs

For startup founders looking to attract future venture capital investment, resilience, innovation, and impact are key. Building a resilient business model that can withstand economic fluctuations and market shifts is crucial. This involves not just financial prudence but also strategic flexibility to pivot when necessary. Leveraging emerging technologies can provide a competitive edge, whether through improving operational efficiencies, enhancing customer experiences, or creating entirely new product categories. Furthermore, demonstrating a commitment to social and environmental impact can significantly increase a startup’s attractiveness to VCs. This includes adopting sustainable practices, addressing societal challenges through your business model, and fostering an inclusive company culture. Entrepreneurs who embody these principles are more likely to resonate with forward-thinking investors.

Envisioning the Next Era of Venture Capital Investment

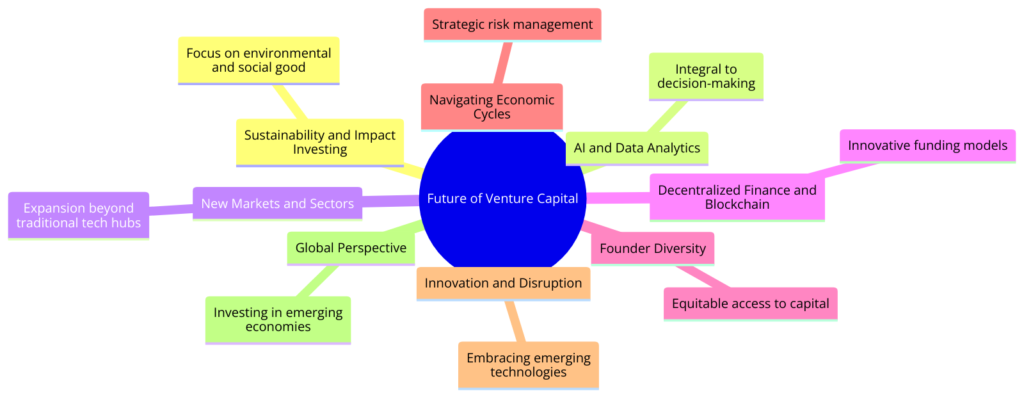

As venture capital (VC) continues to be a major force driving innovation and entrepreneurship globally, the landscape is poised for transformative changes. The mindmap diagram above distills the essence of the future trajectory of VC, highlighting key areas where significant shifts are anticipated.

Emphasizing Sustainability and Social Impact

VC is increasingly gravitating towards investments that promise not only financial returns but also positive environmental and social impacts. This paradigm shift is a response to the growing consumer demand for sustainable practices and the recognition that responsible investments are critical for long-term profitability and societal well-being.

Leveraging AI and Data Analytics

The infusion of artificial intelligence (AI) and data analytics into the venture capital process is revolutionizing how investors source, evaluate, and manage investments. These technologies enable a deeper, data-driven understanding of market trends and startup potential, enhancing the decision-making process and potentially reducing investment risks.

Expanding into New Markets and Sectors

The future of VC includes a broadened focus beyond the traditional tech hubs to emerging markets and sectors. This diversification strategy not only mitigates risk but also uncovers new opportunities for growth in areas previously underserved or overlooked by venture capitalists.

Innovating with Decentralized Finance and Blockchain

Blockchain technology and decentralized finance (DeFi) present new models for funding and startup growth, challenging conventional VC structures. These innovations promise to make the investment process more transparent, efficient, and accessible, potentially democratizing access to venture capital.

Prioritizing Founder Diversity and Equitable Access to Capital

Recognizing the value of diverse perspectives and experiences, the VC industry is moving towards more inclusive investment practices. By prioritizing founder diversity and equitable access to capital, VCs aim to support a wider range of entrepreneurs, fostering innovation and addressing historical imbalances in funding.

As we look to the future, these evolving trends underscore the venture capital industry’s adaptability and its commitment to driving forward-thinking investments. The next era of VC is set to be characterized by a more inclusive, sustainable, and technologically advanced approach, aligning investment strategies with the broader goals of economic growth, innovation, and societal progress.

Top 5 Predictions for the Future of Venture Capital

1. Increased Emphasis on Sustainable and Impact Investing

The future of VC is green and socially conscious. Investors are increasingly prioritizing startups that contribute to environmental sustainability and social good. This shift reflects a broader recognition of the long-term value and profitability of businesses that tackle climate change, promote clean energy, and address pressing social issues. Startups that align their goals with these values are not only contributing to a healthier planet and society but are also positioning themselves as attractive investment opportunities in a rapidly growing market.

2. The Growth of AI and Data Analytics

Artificial Intelligence and data analytics are set to become even more integral to venture capital decision-making. These technologies enable investors to sift through vast amounts of data to identify trends, assess startup viability, and predict market movements with greater accuracy. As AI and analytics tools become more sophisticated, their adoption will likely become a standard practice in VC, allowing firms to make faster, more informed decisions and manage portfolio risks more effectively.

3. Expansion into New Markets and Sectors

Venture capital is breaking boundaries, with investors increasingly looking beyond traditional tech hubs and sectors. Emerging markets in Asia, Africa, and Latin America offer untapped potential, driven by growing economies, technological adoption, and innovative startups addressing local and global challenges. Additionally, sectors like healthtech, agritech, and edtech are gaining traction, offering solutions to critical issues like healthcare access, food security, and education. This geographical and sectoral expansion diversifies investment opportunities and opens new avenues for growth.

4. The Rise of Decentralized Finance (DeFi) and Blockchain Technology

Decentralized finance and blockchain technology are poised to revolutionize venture capital. These technologies offer new models for startup funding, such as tokenization and decentralized autonomous organizations (DAOs), which can provide more democratic, transparent, and efficient ways to raise capital. As these models mature, they could challenge traditional VC structures, offering startups more flexibility in how they fundraise and operate.

5. Enhanced Focus on Founder Diversity and Equitable Access to Capital

Addressing historical imbalances in funding is a growing priority for the venture capital industry. There’s a concerted effort to support startups led by underrepresented founders, recognizing that diversity drives innovation and market growth. This includes not only targeting investments towards these founders but also building more inclusive VC firms and networks to support a broader range of entrepreneurs. This shift towards equity and inclusion will enrich the startup ecosystem, fostering a more vibrant and diverse array of businesses.

The future of venture capital is marked by a conscious shift towards sustainability, technological integration, market expansion, innovative funding models, and inclusivity. These predictions highlight a transformative path for the industry, promising a more dynamic, equitable, and impactful venture capital landscape.

Navigating Uncertainty in VC

Navigating Economic Cycles

Venture capitalists face the perennial challenge of navigating economic uncertainty, a task that demands astute risk management and strategic capital allocation. In periods of economic downturn or market volatility, VCs must exercise caution without stifling innovation. Diversification across sectors and stages of investment can mitigate risks, ensuring that a downturn in one area doesn’t disproportionately affect the entire portfolio. Moreover, maintaining a reserve for follow-on investments in existing portfolio companies can safeguard these ventures through rough patches, ensuring they emerge stronger on the other side. The ability to recognize the cyclical nature of economies and adapt investment strategies accordingly will define the resilience and success of venture capital firms in uncertain times.

Innovation and Disruption

The future of venture capital is inextricably linked to continuous innovation and technological disruption. Staying ahead of trends in emerging technologies such as AI, blockchain, and biotech is crucial for VCs looking to invest in the next big thing. This requires not just a keen eye for technological advancements but also an understanding of how these technologies can be applied to disrupt existing markets or create new ones. VCs that can identify and invest in startups at the forefront of innovation will be well-positioned to reap the rewards of disruption, shaping the investment landscape of the future.

Global Perspective

The globalization of venture capital opens up a world of opportunities and challenges for investors. Emerging markets offer untapped potential, with rapidly growing economies, technological adoption, and innovative startups solving local and global problems. However, investing in these markets or in cross-border startups requires a nuanced understanding of local cultures, regulations, and business practices. VCs that can navigate these complexities, either by partnering with local firms or building in-house expertise, will be able to capitalize on the global expansion of venture capital, driving growth and innovation on an international scale.

Some FAQs Answered on The Relevant Topic

How can startups make themselves more attractive to future VC investment?

Startups can enhance their attractiveness to VCs by demonstrating a clear value proposition, showcasing a scalable business model, and evidencing traction in their market. Incorporating technology to innovate, streamline operations, or disrupt traditional industries can also set a startup apart. Additionally, a commitment to sustainability and social impact can appeal to the growing number of VCs prioritizing responsible investment.

What role will technology play in the future of venture capital decision-making?

Technology, particularly AI and data analytics, will play a pivotal role in venture capital decision-making by enabling more sophisticated market analysis, due diligence, and risk assessment. These tools can help VCs uncover insights faster and more accurately, identify emerging trends, and make informed investment decisions in a rapidly changing world.

How might global economic trends affect venture capital funding in the coming years?

Global economic trends, including fluctuations in market conditions, interest rates, and geopolitical events, could significantly impact venture capital funding. Economic downturns may tighten funding, whereas periods of growth could increase competition for high-potential startups. VCs and entrepreneurs must remain agile, adapting their strategies to thrive under varying economic climates.

What strategies can VCs use to identify and mitigate investment risks in a rapidly changing world?

VCs can use diversification, enhanced due diligence, and continuous market analysis to mitigate risks. Embracing emerging technologies for data-driven decision-making and staying attuned to global trends can also help VCs navigate uncertainties, ensuring they remain resilient and effective in a changing investment landscape.

In Conclusion

The future of venture capital promises a landscape shaped by sustainability, diversity, technological innovation, and global expansion. The key predictions and possibilities discussed highlight the evolving nature of investment strategies, the critical impact of technological advancements, and the growing emphasis on making a positive societal impact. For investors and entrepreneurs alike, the ability to adapt, innovate, and adopt a forward-looking approach will be paramount in navigating this future. Embracing change, leveraging new technologies, and committing to sustainable and inclusive growth will enable stakeholders in the VC ecosystem to drive significant economic and societal advancements. As the venture capital industry moves forward, its participants are called to contribute actively to a dynamic, inclusive, and impactful future, shaping not just the markets of tomorrow but also the world in which those markets exist.